What Does Hsmb Advisory Llc Mean?

Not known Facts About Hsmb Advisory Llc

Table of ContentsAbout Hsmb Advisory LlcThe smart Trick of Hsmb Advisory Llc That Nobody is DiscussingThe smart Trick of Hsmb Advisory Llc That Nobody is DiscussingWhat Does Hsmb Advisory Llc Do?

Life insurance coverage is especially important if your household is reliant on your wage. Market specialists suggest a policy that pays out 10 times your yearly revenue. These might include mortgage repayments, outstanding finances, credit rating card financial debt, taxes, kid care, and future college prices.Bureau of Labor Stats, both partners worked and generated earnings in 48. 9% of married-couple households in 2022. This is up from 46. 8% in 2021. They would certainly be most likely to experience economic difficulty as a result of among their breadwinner' deaths. Medical insurance can be gotten with your company, the government medical insurance marketplace, or personal insurance coverage you acquire for on your own and your family members by speaking to wellness insurance policy business directly or going via a health and wellness insurance representative.

2% of the American populace was without insurance coverage in 2021, the Centers for Disease Control (CDC) reported in its National Center for Health And Wellness Data. Greater than 60% got their protection with an employer or in the exclusive insurance policy industry while the rest were covered by government-subsidized programs consisting of Medicare and Medicaid, professionals' benefits programs, and the federal marketplace established under the Affordable Care Act.

Not known Facts About Hsmb Advisory Llc

If your earnings is reduced, you may be one of the 80 million Americans that are qualified for Medicaid.

Investopedia/ Jake Shi Long-lasting special needs insurance policy supports those that end up being unable to work. According to the Social Safety and security Management, one in four employees getting in the workforce will certainly become impaired prior to they reach the age of retirement. While medical insurance spends for hospitalization and medical costs, you are often strained with all of the costs that your paycheck had covered.

Many plans pay 40% to 70% of your income. The expense of special needs insurance is based on numerous aspects, consisting of age, way of living, and wellness.

Before you purchase, check out the small print. Lots of plans require a three-month waiting duration prior to the insurance coverage starts, supply a maximum of 3 years' well worth of insurance coverage, and have significant policy exemptions. Despite years of renovations in automobile security, an approximated 31,785 individuals passed away in web traffic mishaps on U.S.

The Main Principles Of Hsmb Advisory Llc

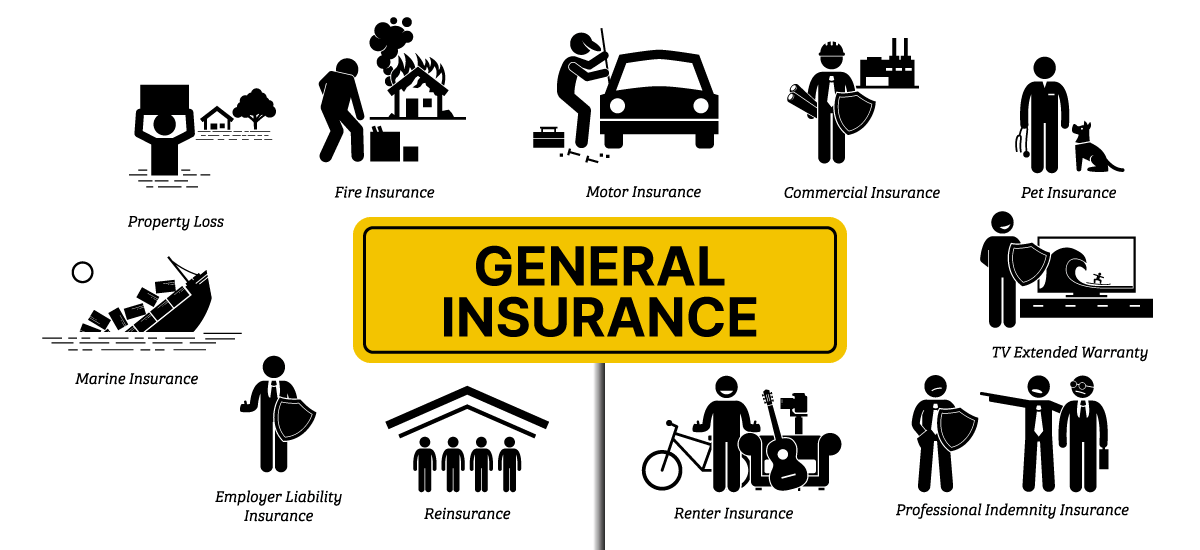

Comprehensive insurance coverage covers burglary and damage to your vehicle because of floods, hail storm, fire, criminal damage, dropping objects, and animal strikes. When you finance your vehicle or rent a cars and truck, this sort of insurance is required. Uninsured/underinsured driver () protection: If a without insurance or underinsured motorist strikes your vehicle, this insurance coverage go pays for you and your passenger's medical expenditures and might likewise represent lost income or make up for pain and suffering.

Company coverage is frequently the ideal choice, yet if that is unavailable, acquire quotes from several carriers as lots of provide price cuts if you purchase greater than one sort of protection. (https://www.dreamstime.com/hunterblack33701_info)

The 7-Second Trick For Hsmb Advisory Llc

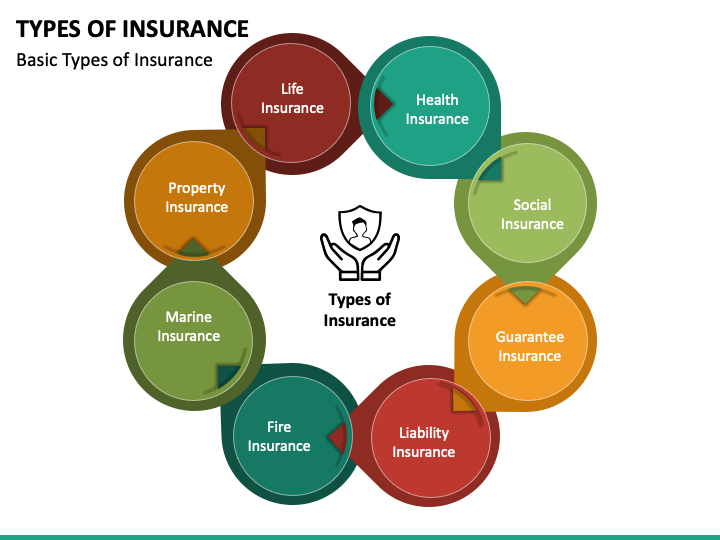

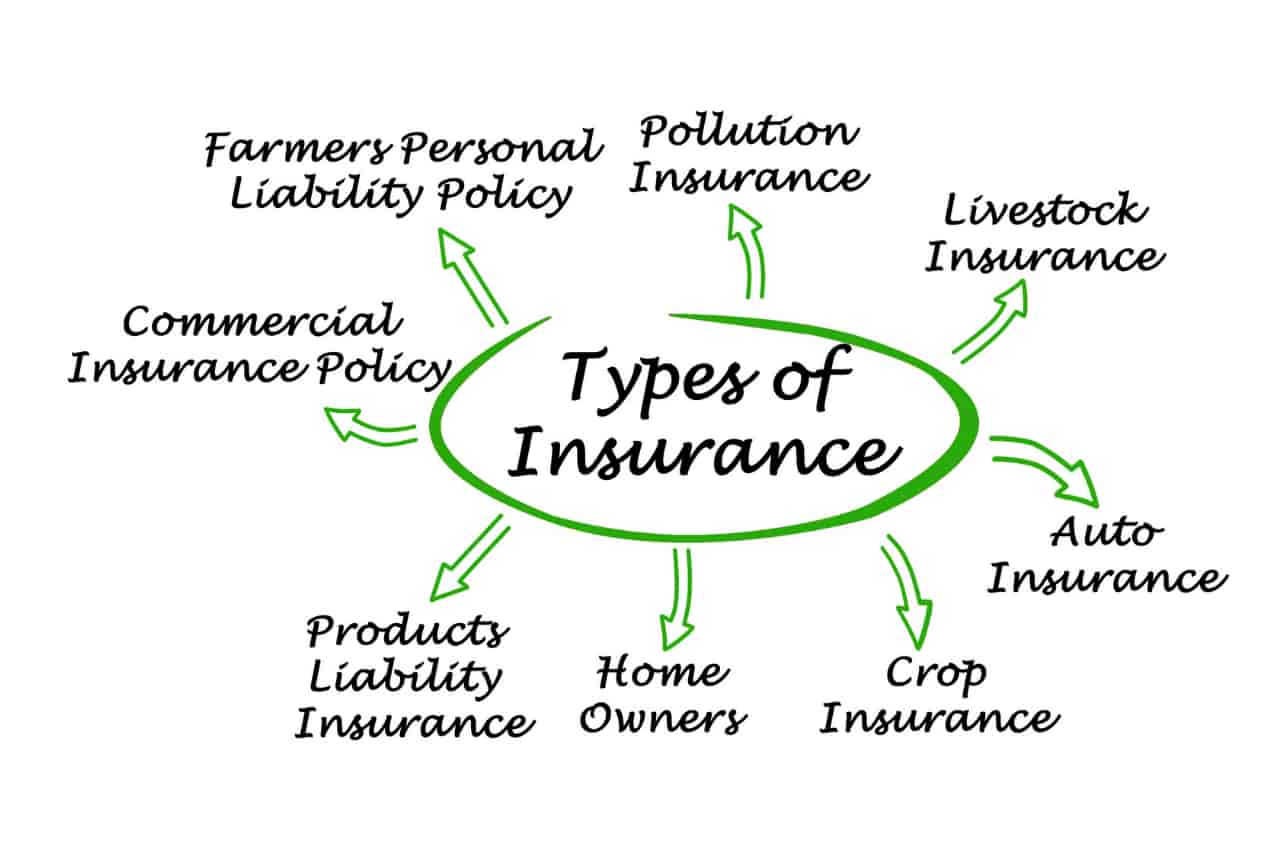

In between health and wellness insurance, life insurance policy, handicap, responsibility, long-lasting, and also laptop insurance policy, the job of covering yourselfand assuming regarding the countless possibilities of what can occur in lifecan feel overwhelming. When you comprehend the fundamentals and make certain you're sufficiently covered, insurance policy can enhance monetary self-confidence and well-being. Right here are the most essential kinds of insurance you require and what they do, plus a pair tips to avoid overinsuring.

Different states have various guidelines, however you can expect health and wellness insurance (which many individuals get via their employer), auto insurance (if you own or drive an automobile), and house owners insurance (if you have home) to be on the listing (https://www.cheaperseeker.com/u/hsmbadvisory). Mandatory sorts of insurance policy can transform, so check up on the most up to date laws from time to time, especially before you restore your plans